Update on international container shipping and logistics market on Asia, Europe and North America routes in Week 9/2024.

Phaata updates international shipping and logistics market Week 9-2024

Phaata updates international shipping and logistics market Week 9-2024

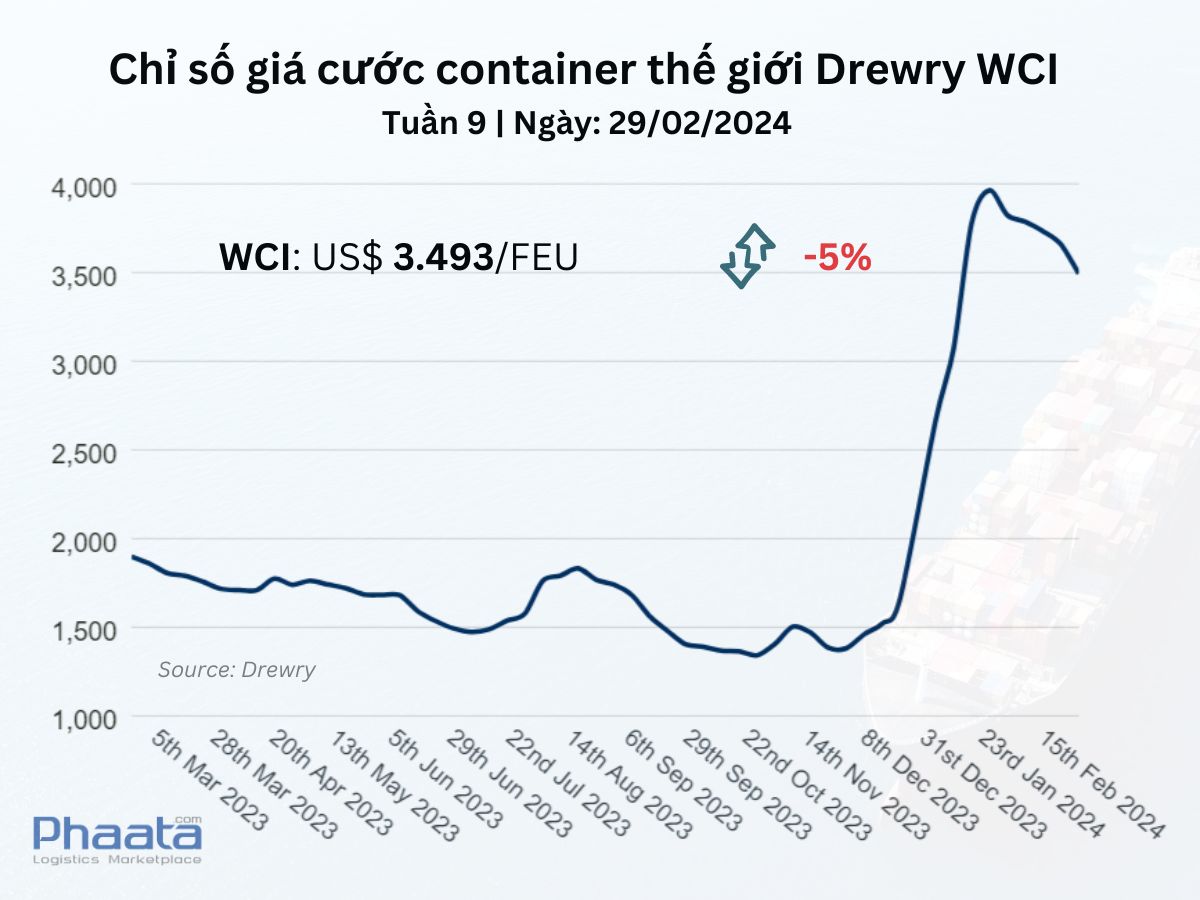

The Drewry Composite World Container Rate Index for the week of September 2024 continued to decline by 5% compared to the previous week, to USD 3,493. This rate index is up 88% compared to the same week last year and 146% higher than the pre-pandemic average of 2019 (USD 1,420).

Drewry Composite World Container Rate Index Week 9/2024 (Source: Drewry)

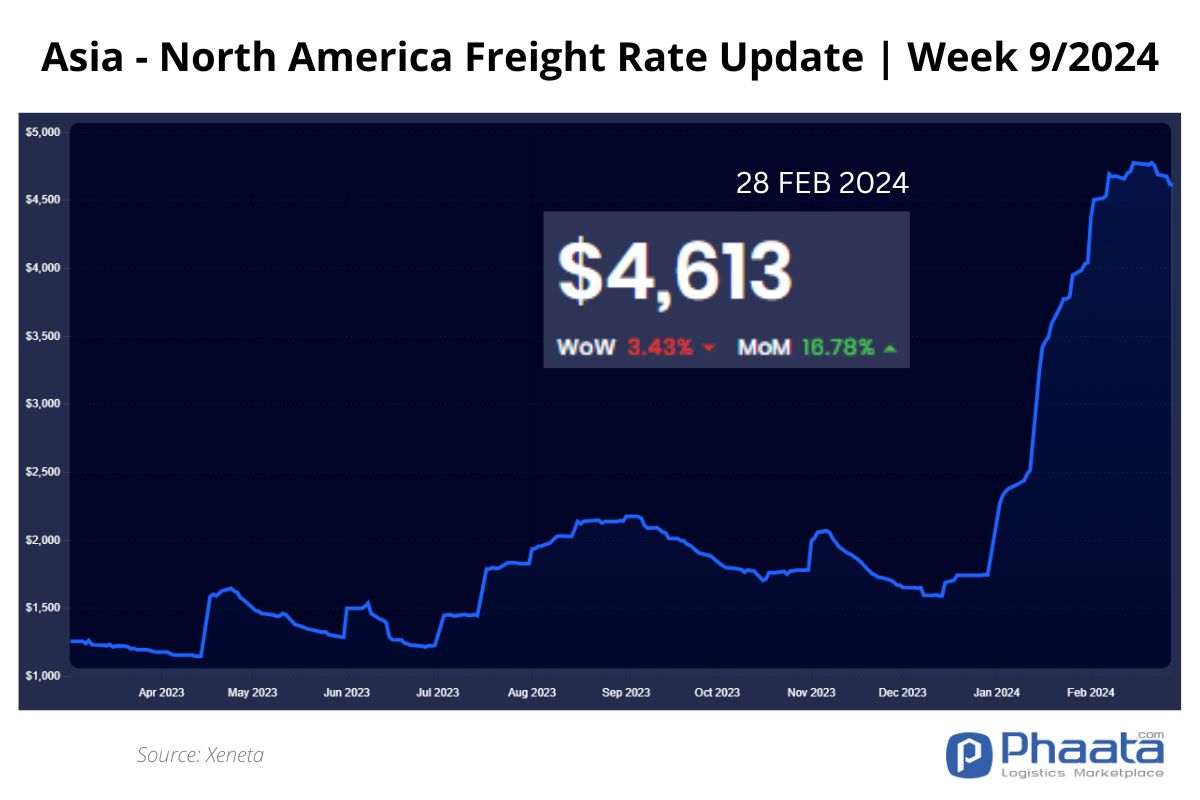

1. Shipping lane: Asia – North America

Ocean Freight rates from Asia to the West Coast of North America in week 9/2024 decreased to $4,613/FEU, down 3.43% week-on-week and up 16.78% month-on-month, according to Xeneta data.

Due to the situation in the Red Sea, vessels are unable to return empty containers to Asia in time to meet demand. If the situation does not change, there may be a shortage of equipment.

Carriers are evaluating the possibility of adding more vessels to the routes via Suez. Alternative routes could be via the Suez Canal or via the US West Coast by rail. In addition, carriers are also enforcing an average weight limit of 8 tonnes for containers moving through the canal. Traveling through Panama remains the fastest route to the US East Coast.

Asia-North America Freight Rates | Week 9/2024 (Photo: Phaata.com)

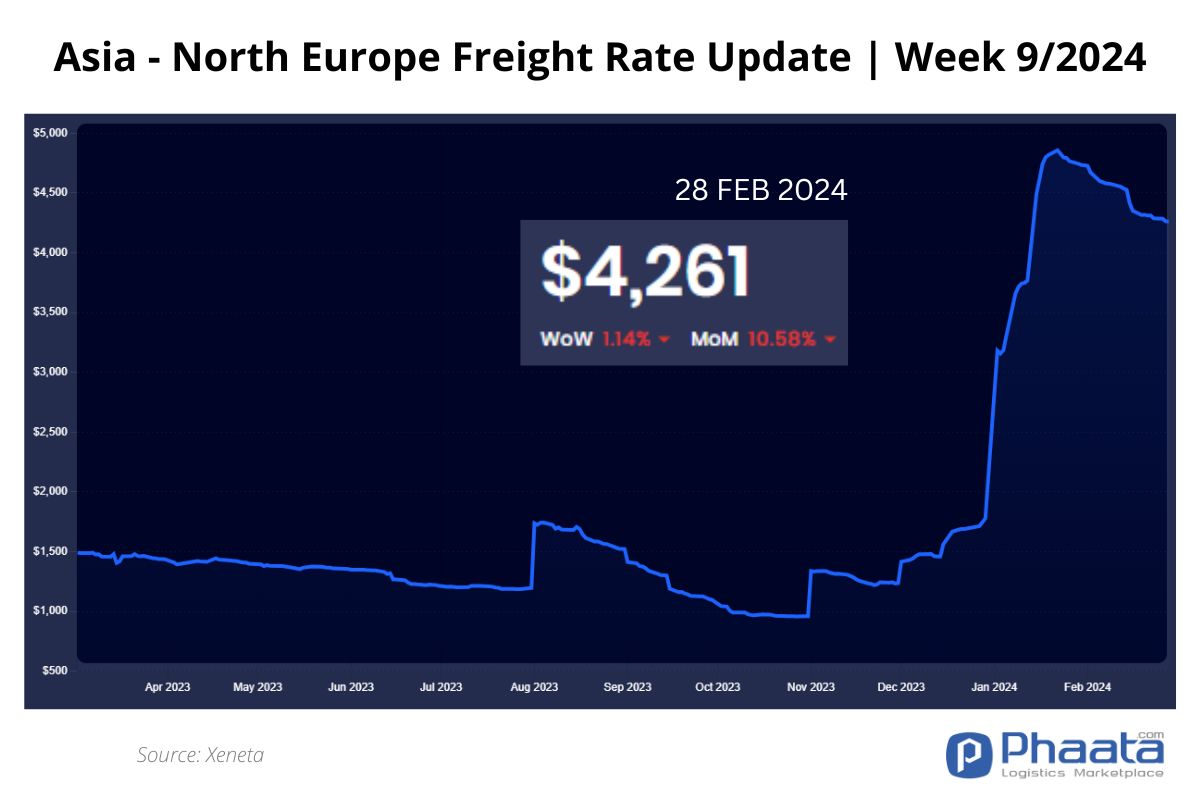

2. Shipping lane: Asia – Europe

Freight rates from Asia to North Europe continued to decline slightly in the week of September 2024 to USD 4,261/FEU, down 1.14% week-on-week and 10.58% month-on-month, according to Xeneta data.

Due to the situation in the Red Sea, vessels are unable to return empty containers to Asia in time to meet demand. If the situation does not change, there may be a shortage of equipment in the coming weeks.

Spot rates continue to rise sharply as the threat from the Red Sea has forced most carriers to reroute vessels from the Suez Canal to the Cape of Good Hope. This has significantly increased shipping costs and is expected to add 2-4 weeks to the total transit time depending on the destination of the vessel. We predict that this spot rate hike will not stop easily even after the Lunar New Year.

Asia-Europe Freight Rates | Week 9/2024 (Photo: Phaata.com)

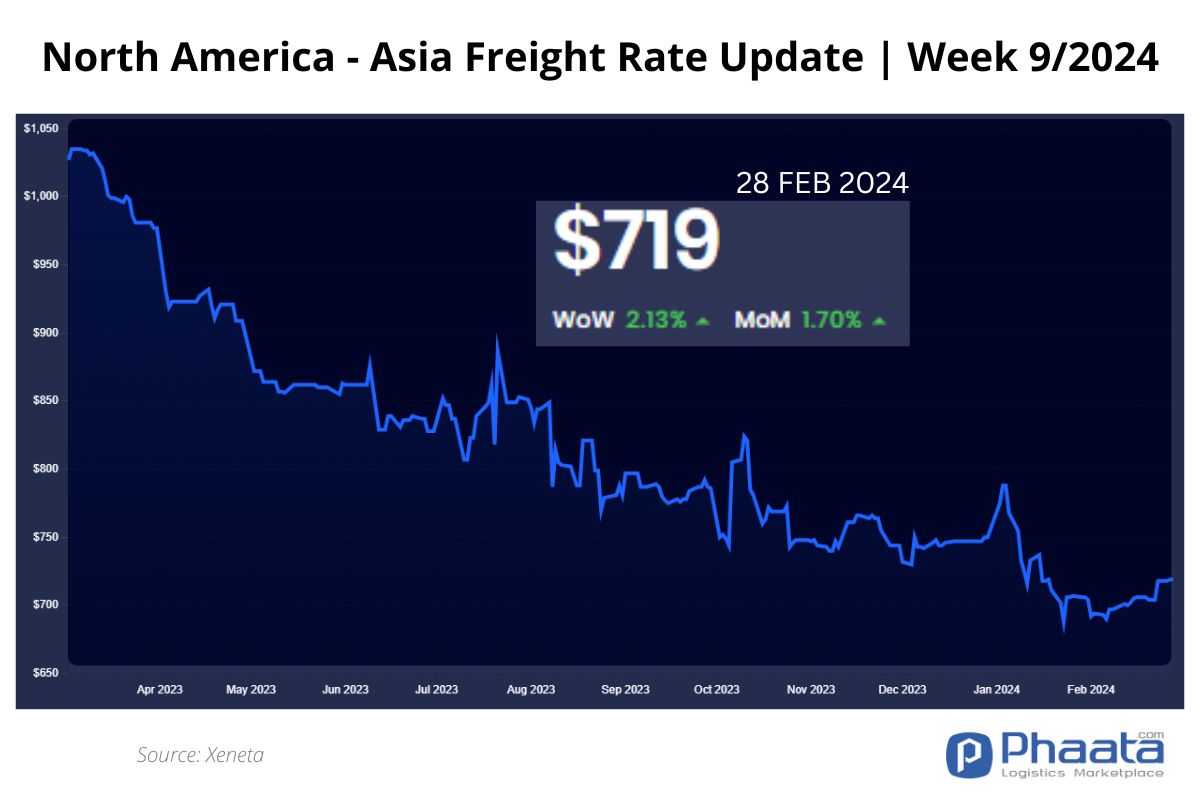

3. Shipping route: North America – Asia

Freight rates from North America (West Coast) to Asia in week 9/2024 continued to increase by 2.13% compared to the previous week, to 719 USD/FEU. This price increased by 1.70% compared to the previous month.

There is a shortage of empty containers at many rail terminals in the US mainland due to a lack of imported goods to the Midwest. Shippers should book 2-3 weeks in advance to ensure container equipment for export plans.

Demand remains weak overall and is forecast to last until the end of Q1 2024. Fierce competition is ongoing among carriers. Freight rates continue to be offered by carriers at attractive levels to fill vessels when there is still excess capacity.

North America – Asia Freight Rates | Week 9/2024 (Photo: Phaata.com)

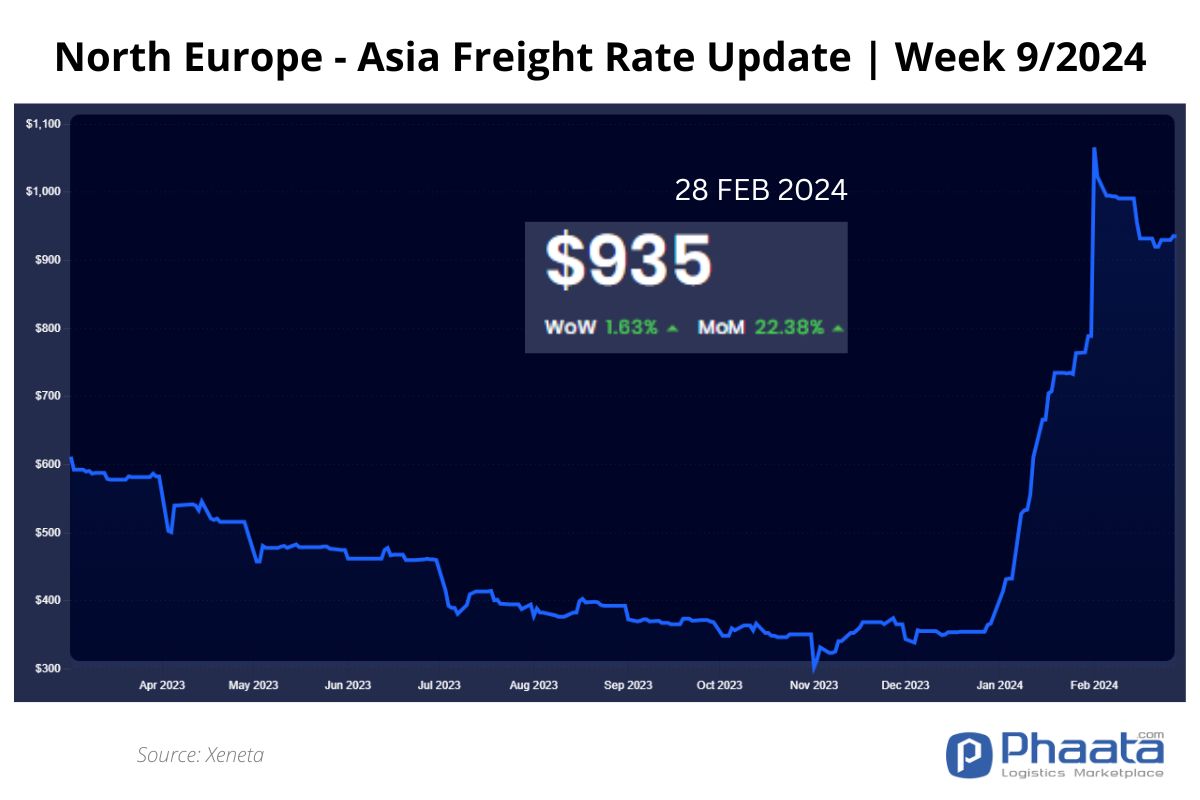

4. Shipping route: Northern Europe – Asia

Freight rates from Northern Europe to Asia in week 9/2024 increased slightly to 935 USD/FEU, equivalent to an increase of 1.63% compared to the previous week; and an increase of 22.38% compared to the previous month.

Northern Europe-Asia Freight Rates | Week 9/2024 (Photo: Phaata.com)